Wage growth slows ‘markedly’ in a boost for the Bank of England

Strong wage growth has been a concern for policymakers at the Bank of England due to fears that it could keep cost pressures elevated, particularly in the labour-intensive services sector.

Wage growth eased “markedly” over the summer in a boost for the Bank of England’s hopes of vanquishing inflation, new figures from the Office for National Statistics (ONS) show.

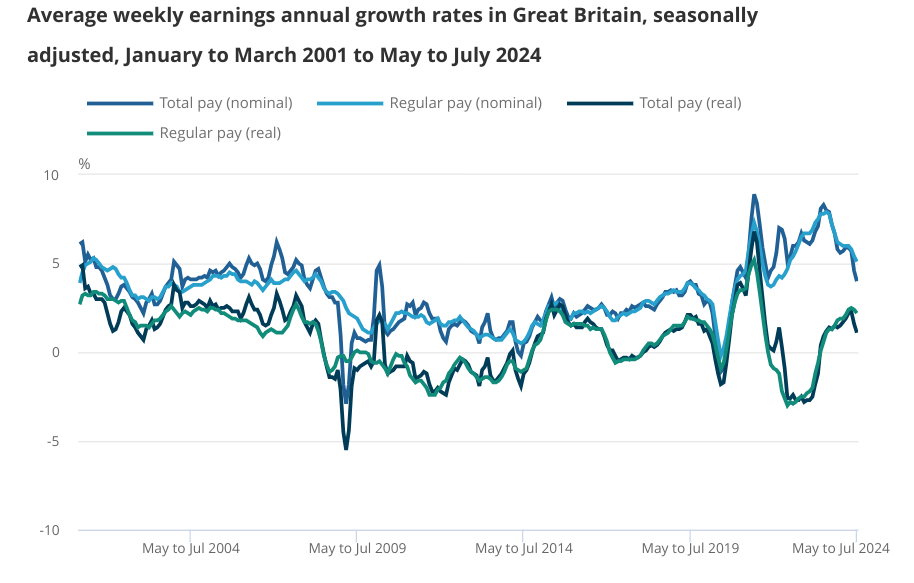

In the three months to July, annual wage growth including bonuses slowed to 4.0 per cent, its slowest pace of growth since November 2020.

This was down from 4.5 per cent last month and a slightly larger fall than economists had anticipated.

Excluding bonuses, pay growth eased to 5.1 per cent from 5.4 per cent previously, which was in line with expectations and the slowest rate of pay growth since June 2022.

“Growth in total pay has slowed markedly again as one-off payments made to many public sector workers in June and July last year continue to affect the figures,” ONS director of economic statistics Liz McKeown said.

“Basic pay growth also continued to slow, though less sharply,” McKeown added.

Strong wage growth has been a concern for policymakers at the Bank of England due to fears that it could keep cost pressures elevated, particularly in the labour-intensive services sector.

Larger pay packets also mean consumers have more disposable income, enabling them to spend more on goods and services.

But pay growth has eased from peaks of around eight per cent last summer, suggesting that the Bank’s aggressive rate hikes have successfully contained inflationary pressures.

Unemployment meanwhile dipped to 4.1 per cent in the latest set of figures, slightly lower than last month’s reading of 4.2 per cent but in line with expectations.

Official measures of unemployment are still subject to unusual levels of uncertainty due to the well-publicised difficulties with the flagship labour force survey.

The ONS advised “caution” when using the data citing “ongoing challenges” with response rates.

Other measures in the release pointed to growing slack in the labour marker. Vacancies decreased for the 26th consecutive quarter, taking the number of job openings to its lowest level in two years.

The number of payrolled employees in August also fell by 59,000, the fourth decrease in the last five months.

Yael Selfin, chief economist at KPMG UK, said that the data pointed to “a softening over the coming months as hiring intentions continue to slow, which should see a gradual rise in unemployment”.

The Monetary Policy Committee (MPC) will announce its latest decision on interest rates next week, with markets widely expecting the Bank to hold rates.

The Bank cut rates for the first time since the pandemic last month but policymakers have insisted they have to be cautious going forward.

“The second-round inflation effects appear to be smaller than we expected. But it is too early to declare victory,” Andrew Bailey said in a speech at the end of August.

Though traders expect a hold next week, they still think the Bank is on track to cut interest rates once more before the end of the year and today’s figures will have done little to change the calculation.

Michael Brown, senior research strategist at Pepperstone said the figures were “highly unlikely to materially alter the BoE policy outlook”.