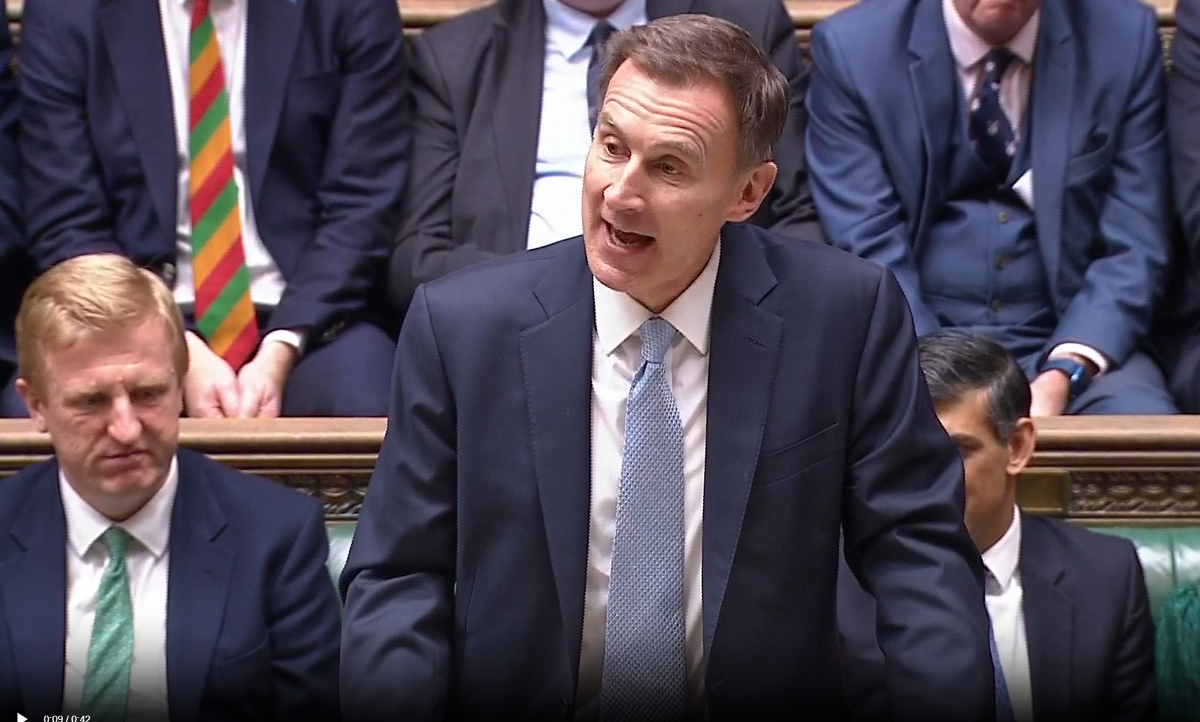

Why Jeremy Hunt’s hopes of another round of tax cuts look remote

Although these figures do not directly feed into Hunt's fiscal headroom at the next fiscal event, it is a sign of just how little wiggle room the Chancellor will have to cut taxes.

Jeremy Hunt’s hopes of another big round of pre-election tax cuts are looking more and more unlikely after this morning’s borrowing figures.

Weaker-than-expected tax revenue meant the government borrowed £11.9bn in the month, ahead of the £10bn expected by economists.

Combined with upside revisions to January and February, the government had to borrow just over £120bn in the 2024 financial year, £6.6bn more than the Office for Budget Responsibility (OBR) forecast only a month ago.

Although these figures do not directly feed into Hunt’s fiscal headroom at the next fiscal event, it’s a sign of just how little wiggle room the Chancellor will have to cut taxes.

Remember, in November, he left himself a cushion of just £8.9bn to meet his key fiscal target of reducing debt in the fifth year of the OBR’s forecasts.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said his cushion could easily be wiped out by “small forecast errors”.

If Hunt decides to announce a pre-election fiscal event later this year, he will undoubtedly be treading very fine margins again. Reports over the weekend suggested that the Treasury is working towards a September fiscal event in which National Insurance might be cut by another 2p, costing around £9bn.

But the real worry for Hunt is not this morning’s overshoot. It is that things are unlikely to get any better in the months to come.

Over the past few weeks markets have pared bets on interest rate cuts, now expecting just two rate reductions this year. This will force the government to spending more on debt servicing. That money will have to come from somewhere, narrowing the path to another round of tax cuts.

“Based on current market pricing…more than half of that already-small leeway has been lost to higher debt servicing costs,” Andrew Goodwin, senior economic advisor to the EY Item Club, said.

For this reason, Goodwin thought another round of giveaways was unlikely. “Unless the Chancellor is prepared to assume even greater spending restraint, it’s unlikely there will be another tax-cutting fiscal event before the election,” he said.

Wood, however, thought that the Chancellor would be able to cut taxes again because the fiscal rules are fairly easy to game.

The forecasts will roll forward meaning Hunt will have an extra year to meet his target. Clearly this does not reflect an fundamental improvement in the UK’s fiscal position.

The Chancellor will also almost certainly plan for another year of “unrealistically weak spending…(to) manufacture the funds to cut taxes,” Wood said.

Whatever he chooses, the good news for Hunt is he won’t be the one picking up the pieces after the election.