Why this broker thinks the IAG share price can more than double

Analysts say shares in British Airways owner the IAG could more than double as investors look forward to a first dividend since the pandemic.

Analysts are backing the share price of British Airways owner the IAG to more than double amid soaring travel demand.

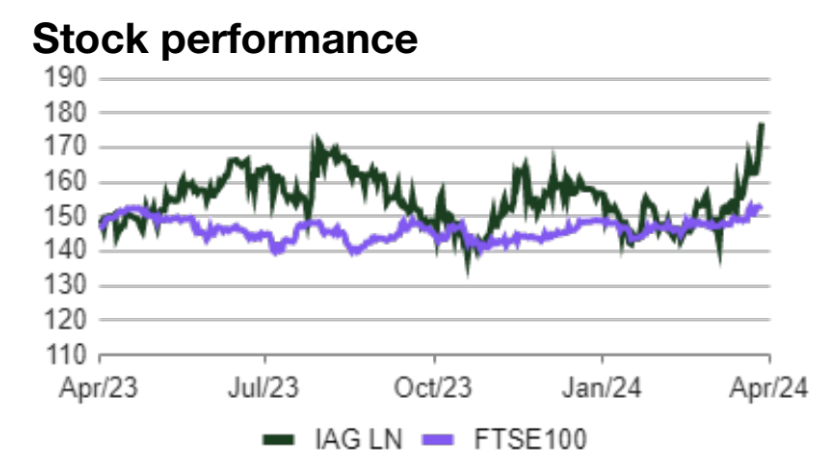

The IAG share price has jumped 13 per cent this year to date, and Liberum has now recommended a target price of 450p. The broker published the price target after the airline conglomerate, which also owns Iberia and Vueling, reported a record £3bn annual operating profit in February, more than double the prior year.

Gerald Khoo, an analyst at the broker Liberum, noted the firm’s depressed rating continued to price in an “absurdly negative outlook.”

“This overlooks its record of sustained high returns prior to the pandemic, and the supportive

demand/supply balance going forwards,” he said.

Liberum’s view rests on the critical importance of airline’s demand outlook, coming off the back of a year in which passenger traffic rebounded dramatically from Covid-era lows.

IAG share price benefits from travel rebound

Travel demand has not let up into the new year, while the IAG’s pre-pandemic record of strong returns puts its long-term earnings potential in a strong position. The current price implies mid-cycle earnings are 60 per cent below 2023 levels, a level not seen since 2013, the broker argued.

Liberum also noted the IAG’s track record of higher returns on invested capital (ROIC), which is used to determine how well a company allocates its capital to profitable projects or investments, and strong balance sheet.

What’s more, the FTSE 100 airline operator is expected to pay a 3.3 cent (2.6p) per share dividend in 2024, and in 2025, the dividend is forecast to soar to 6.1 cents (4.8p) per share. Investors haven’t received payouts since before the pandemic.

The IAG’s first quarter results are scheduled for 10 May. The results could provide a catalyst for the IAG share price to re-rate.

In its full-year results, the company said demand continued to be “robust” and bookings for the first half were ahead of last year. Its debt, a key concern of investors, dropped to €9.2bn (£7.9bn) from €10.4bn (£9.3bn). Capacity is expected to grow around seven per cent in 2024.

Industry headwinds

There are headwinds, however. Any material weakening of the macroeconomic outlook could cause consumers to tighten their belts, undermining travel demand.

Major suppliers Airbus and Boeing are struggling with ongoing supply chain issues, restricting the delivery of aircraft to the market.

And heightened geopolitical tension across the globe is posing a risk to oil prices and, by extension, fuel costs. Indeed, in recent days, the price of Brent crude has jumped back to $90 a barrel on geopolitical tensions.

The month the war between Israel and Hamas started, the IAG share price fell over three per cent. Shares in Easyjet, Jet2 and Wizz Air also dropped, with Wizz falling a nearly 20 per cent.

Annual fuel, oil costs and emissions charges increased by €1.4bn year-on-year in 2023, although the company is well hedged, which should soften the blow if oil prices continue to rise.