Wisconsin’s Investment Board becomes first state pension fund to invest in Bitcoin spot ETFs

During previous cycles, the anticipation of institutional involvement in crypto was a driving force for demand. “The institutions are coming" was a common claim on Crypto Twitter, often repeated after rumours of a large financial firm entering the market echoed through Telegram chats and Discord servers.

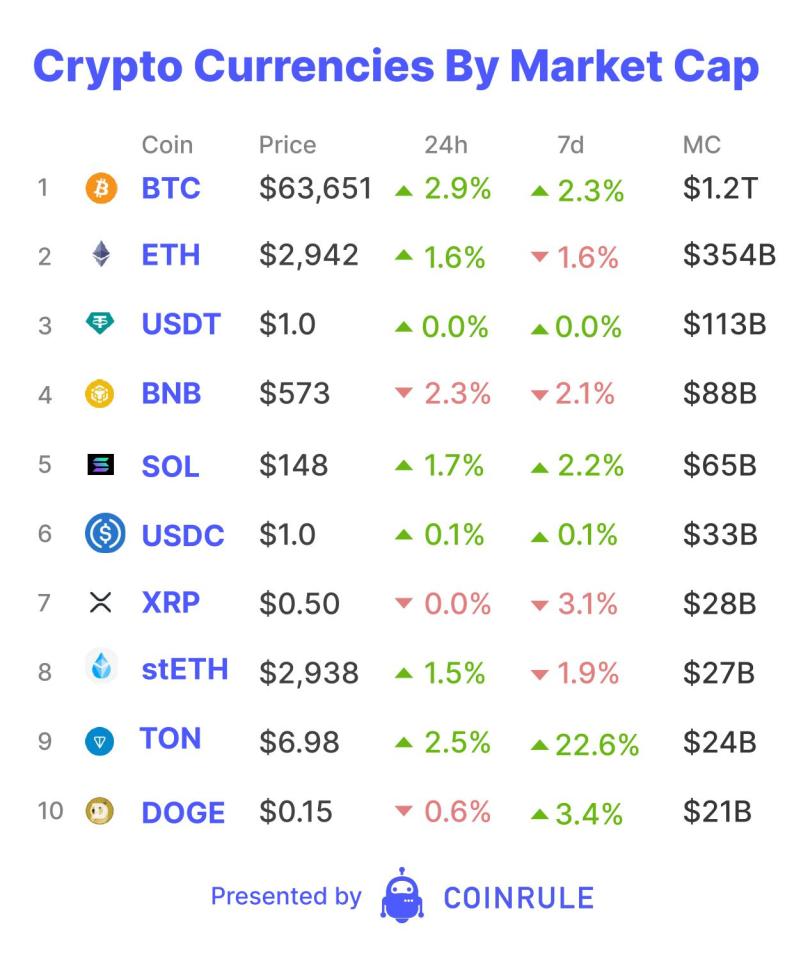

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

During previous cycles, the anticipation of institutional involvement in crypto was a driving force for demand. “The institutions are coming” was a common claim on Crypto Twitter, often repeated after rumours of a large financial firm entering the market echoed through Telegram chats and Discord servers. After the latest quarterly investment disclosures, it does indeed seem the institutions are here. For now though they are just dipping their toes opposed to jumping head first into the crypto waters.

One of the most surprising entities exposed to the Bitcoin spot ETFs is The State of Wisconsin’s Investment Board. This fund is responsible for making investments on behalf of the Wisconsin retirement system and the state’s investment fund. At the beginning of 2024, they managed over $156 billion of assets. They currently hold over $162 million of Bitcoin spot ETFs and are now the first state pension fund to allocate to them. According to Macroscope, the fund is now also the second largest reported holder of BlackRock’s IBIT with around $100 million allocated.

Matt Hougan, Chief Investment Officer at Bitwise, commented on these latest discourses. He stated that these initial investments are likely “just a down payment,” with the firms initially allocating their own capital before they risk their clients’ funds. Typically it takes around 6-12 months for funds to assess a new investment. This also potentially means that a lot of funds are still making their decision on whether or not to invest in Bitcoin ETFs. Hougan also mentioned that after six months of being invested, funds then begin allocating for all their clients. A normal portfolio allocation would be from 1-5%. However, fund manager, Pine Ridge Advisors is holding around $205 million in Bitcoin spot ETFs. This incredibly makes up 23% of their $890 million of assets.

Hougan also remarks that as of last Thursday, 563 professional investment firms own $3.5 billion of Bitcoin ETFs. Currently, that’s only around 7% of the approximately $50 billion held in the ETFs. This suggests the majority of ETF buyers so far have been retail with institutions moving slower. Eric Balchunas, Senior ETF analyst at Bloomberg, also commented that even these initial allocations are surprisingly bullish. He said “Normally you don’t get these big fish institutions in the 13Fs for a year or so when the ETF gets more liquidity.”

The main standout in the market has so far been the $8 trillion behemoth Vanguard who has ignored the Bitcoin spot ETFs. This is even with them being leaders in the ETF space. Now, however, they’ve got a new CEO – Salim Ramji. Interestingly, Ramji oversaw BlackRock’s filing and implementation of their Bitcoin spot ETF – IBIT. Could Ramji’s pro-crypto stance mean that another major player could be entering the Bitcoin spot ETF battle?