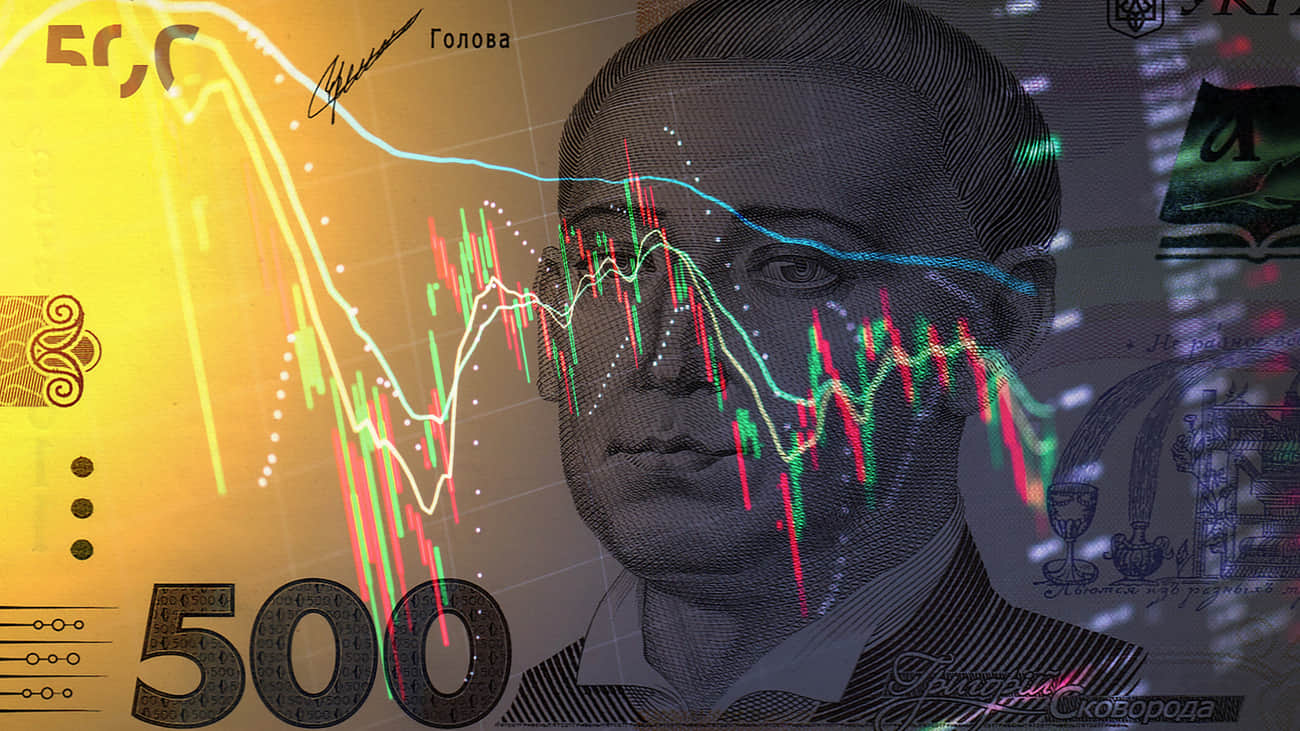

Zelenskyy signs historic tax rise into law

President Volodymyr Zelenskyy has signed a historic tax increase into law. Source: website of the Verkhovna Rada (Ukrainian parliament) Details: Yaroslav Zhelezniak, Deputy Head of the Tax Committee, said the law would come into force on 30 November.

President Volodymyr Zelenskyy has signed a historic tax increase into law.

Source: website of the Verkhovna Rada (Ukrainian parliament)

Details: Yaroslav Zhelezniak, Deputy Head of the Tax Committee, said the law would come into force on 30 November.

The tax increase includes the following changes, as previously reported:

- The military tax on salaries of individuals (including those participating in the Diia.City programme for IT businesses) will rise from 1.5% to 5% from the date the law comes into force. The exception is military personnel (for whom the rate will remain 1.5%).

- The military tax on other income (except salaries) will rise from 1.5% to 5% starting from 1 January 2025.

- A military tax of 10% of the minimum wage (currently UAH 800 or roughly US$19.25) will be introduced for sole traders in groups 1, 2 and 4.

- A military tax of 1% of income will be introduced for sole traders in group 3.

- The corporate income tax rate for banks will rise from 25% to 50% in 2024. Since banks have already paid taxes at the previous rate for most of the year, the new rate will be applied retrospectively.

- The corporate income tax rate for non-banking financial institutions (except insurance companies) will rise from 18% to 25% from 1 January 2025.

Background:

- Ukraine's Tax Committee supported the cancellation of a retroactive tax increase for sole traders in 2024.

- The Ukrainian parliament passed draft law No. 11416-d on tax increases on 10 October 2024.

Support UP or become our patron!